In a turn that has raised alarms among the investment community, a group of shareholders has urged GungHo Online Entertainment Inc., the company behind the iconic game Puzzle & Dragons, to “improve its games.” According to a detailed 32-page report prepared by investment advisor Strategic Capital, the company is facing serious criticism for its prolonged reliance on the success of Puzzle & Dragons, while its president’s compensation has skyrocketed amid a significant drop in profitability.

Context: Puzzle & Dragons and its History

Originally launched in 2012, Puzzle & Dragons marked a milestone in the mobile industry by becoming the first game in the sector to reach $1 billion in revenue, a figure that skyrocketed to $6 billion by 2017. However, in the 13 years since its release, GungHo Online appears to have failed to diversify its success, relying almost exclusively on this title to sustain its revenue.

Strategic Capital Report Criticisms

The report titled “Proposal for GungHo Online Entertainment Inc to up its game”, which you can read here, highlights several critical points regarding the company’s strategy:

- Dependence on Puzzle & Dragons:

Despite having launched around 20 subsequent games, including titles linked to popular IPs such as Disney and Yo-kai Watch, the company has failed to move away from the shadow of Puzzle & Dragons, leading to a lack of diversification in its revenue streams. - Disproportionate Investment in New Projects:

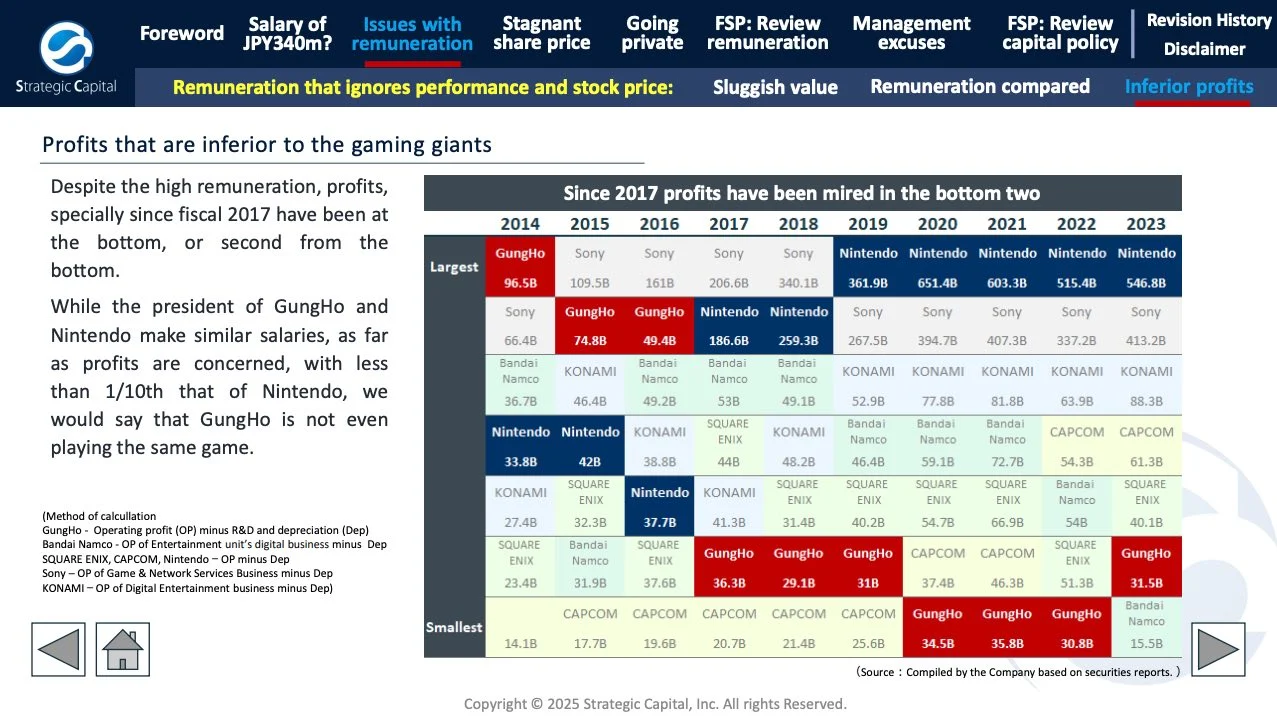

It is estimated that GungHo has invested over ¥100 billion (approximately $645 million) in the development of new games outside of the Puzzle & Dragons universe, while these projects have generated less than ¥10 billion (around $64.5 million) in revenue. - Comparisons with Other Industry Giants:

The report highlights that, unlike other industry giants such as Nintendo, Capcom, Konami, Sony, Bandai Namco, and Square Enix, GungHo is the only company with a negative return for shareholders over the last 10 years. The comparison focuses particularly on the fact that GungHo’s market capitalization is considerably lower than its competitors.

Furthermore, Strategic Capital highlights that GungHo has “excessive” cash reserves. Although having large reserves may seem beneficial in principle, shareholders frown upon the fact that this money is kept idle and reserved for crisis situations rather than being invested in the development of new projects that drive growth and diversification.

The Controversy Surrounding the President's Remuneration

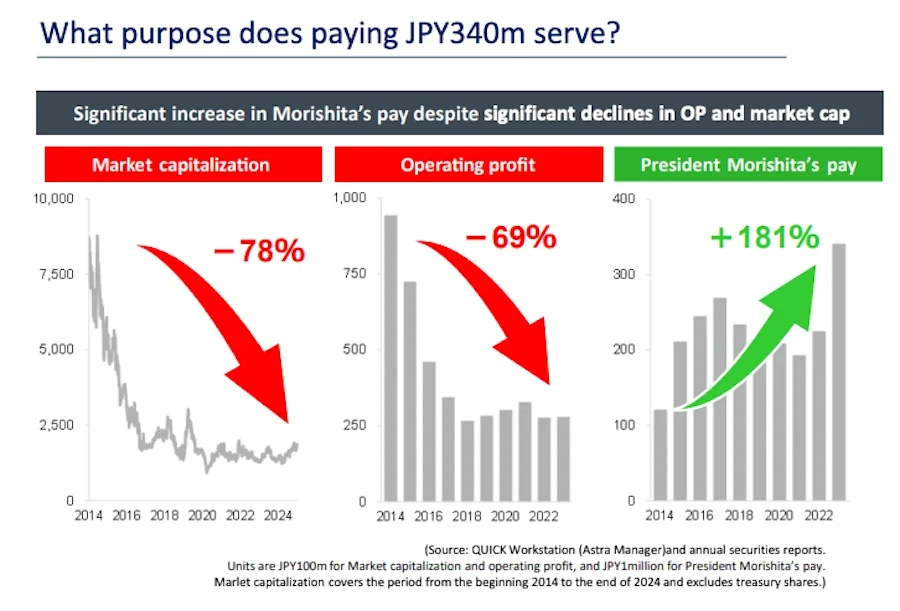

One of the most controversial aspects highlighted in the report is the notable increase in the remuneration of the President and CEO, Kazuki Morishita. Over the last decade, his salary has risen from ¥120 million (approximately $775,000) to ¥340 million (around $2.19 million), despite the company’s market capitalization falling by 78% and operating profits decreasing by 69% in the same period.

The report raises difficult questions about the company’s management:

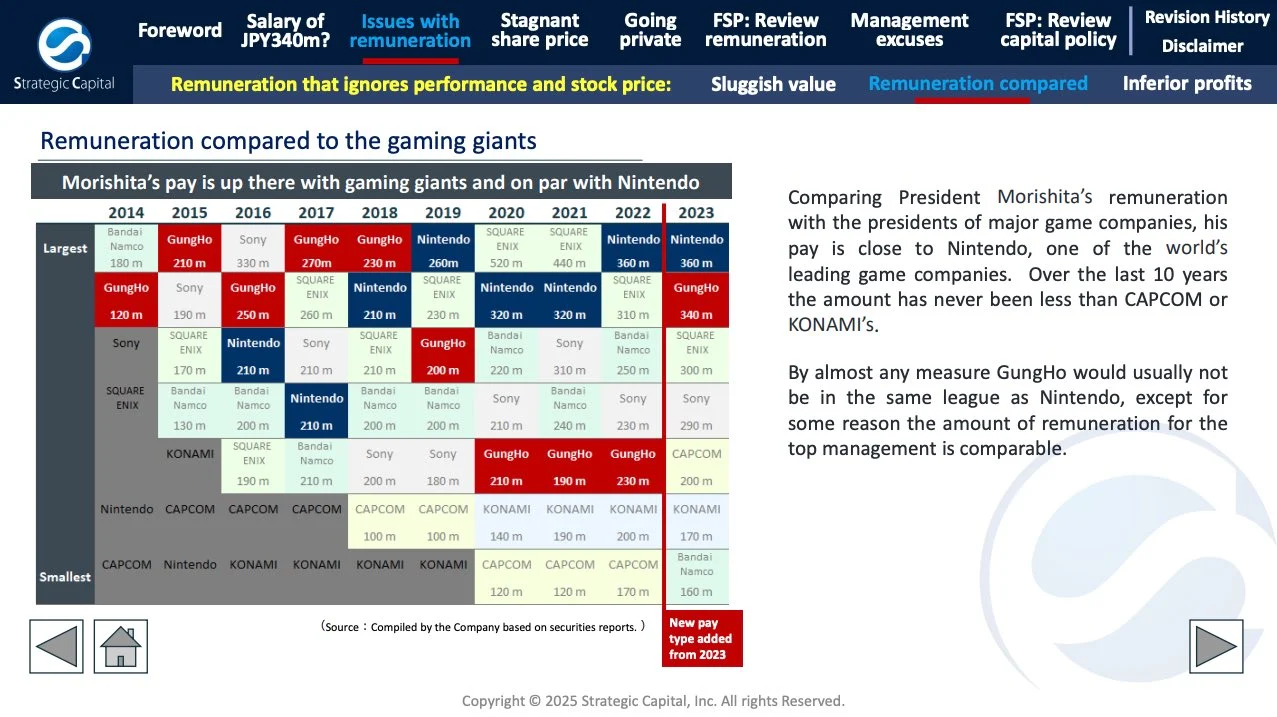

“Comparing President Morishita’s remuneration with the presidents of major game companies, his pay is similar to that of Nintendo, one of the world’s leading game companies. Over the last 10 years, the amount has never been less than that of Capcom or Konami. By almost any measure, GungHo would usually not be in the same league as Nintendo, except that, for some reason, the amount of remuneration for top management is comparable.”

This comparison with industry leaders has sparked a strong reaction among shareholders, who believe that, despite a salary similar to that of executives from top-tier companies, GungHo’s financial results do not support such compensation.

Proposals for Solid Financial Stability

- Private Partnership: The proposal suggests that entering into a private partnership with another company is the best option for GungHo. This collaboration would allow it to diversify its revenue streams and expand its reach, reducing its reliance on historical titles like Puzzle & Dragons and Ragnarok Online.

- Review of the Remuneration System: The company is urged to conduct a fundamental review of its remuneration system, seeking to align executive incentives with the company’s actual performance and improve transparency in decision-making.

- Efficient Use of Cash Reserves: Strategic Capital argues that GungHo should make better use of its large cash reserves to fund the development of new games that can achieve commercial success. This strategic investment could reverse the negative trend in market capitalization and improve investor confidence.

Implications for GungHo Online

What do you think about Strategic Capital’s criticisms of GungHo? Leave your comment below!